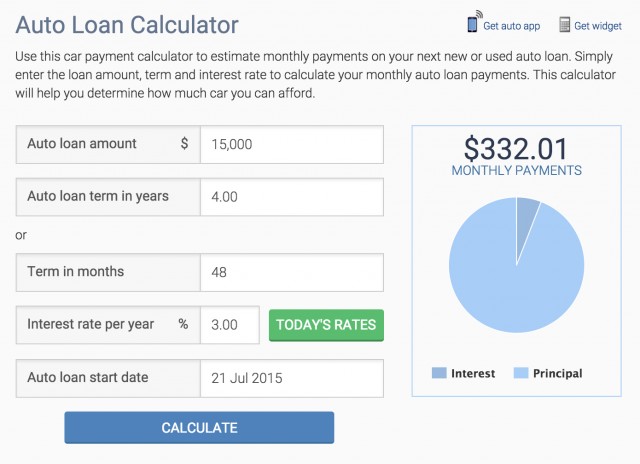

Most people start their journey to the purchase of their next vehicle with a test drive. While it’s certainly more fun than looking up interest rates or creating a purchase plan, the test drive should really come further down the line. Where you should really start your buying process is on a site like Bankrate. There are many different auto loan calculators out there, My Auto Loan is helpful on a few fronts, Cars.com has a good one, but many of them use figures from Bankrate. I always like to go directly to the source of information whenever possible, so using Bankrate to calculate how much car you can actually afford makes sense.

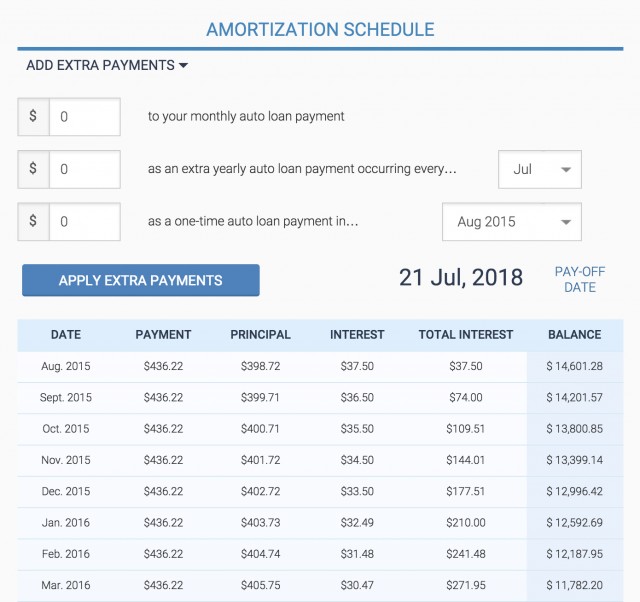

In addition to the auto loan calculator, Bankrate also offers an Amortization Schedule where you can add in extra payments you plan to make. You’ll instantly see how additional payments effect your overall schedule and when, if ever, those payments make sense for you financially. The most important part of buying a car is to have a clear and concise plan in place for how you plan to pay for it. Laying everything out on the table is the only way to make sure you get the best deal possible. Negotiating a good purchase price is a big part of the equation, but unless you’re fortunate enough to be able to pay cash for your vehicles, you need to be as informed as possible on the loan front. It is equally as important to shop around for the best auto loan, as it is to shop around for the best deal on a vehicle.

In order to get the best loan, you’ll want to know your credit score, and although there are a number of ways to monitor that, I recommend Credit Karma. It’s free and gives you both your Transunion and Equifax scores. Although it is helpful to know these scores, there’s no guarantee that the dealer or lender will be using either of them. There are hundreds of credit reporting bureaus in the United States and a dealer can use more than one of them to get your information. You’re certainly welcome to ask them which credit bureau they use, but they don’t have to disclose that, and some sales people won’t even know the answer. I’ve come across that myself and if a sales person doesn’t know that information, I’m not exactly inclined to work with them on the purchase of a vehicle.

Of course all of this information is useless, unless you’ve got a solid way to determine if you’re getting a good deal on the vehicle you want. Between comparing results from a general AutoTempest used car search and price guides from websites like Hagerty, you should have a pretty clear idea of where prices should fall. Once you’ve narrowed down the value window that matches your budget, you can start thinking about how to negotiate a good deal. Many people who use AutoTempest tend to search for vehicles with no minimum or maximum value. That’s fine when simply browsing the web to see whats out there, but when you get serious about buying, you’ll want to make the window as specific as possible. The only way you get to that window, is by starting out on a site like Bankrate to calculate what you can really afford.

There will always be specials, incentives, cash back offers, and preferred customer financing available. These things can help, but only if you go into a dealer with all the information available to you, will you maximize their potential. Many buyers will not be eligible for promotions, that has a big impact on the purchase. Suddenly, what seemed like a possibility is out of reach, and you’re already there, so what do you do? You think about deviating from the plan, maybe not by much, maybe by $20 or $50. Then you think back to your research, you know what an increase of $50 does, you know it’ll put you over budget. So you do the right thing and you walk away. You don’t have a new vehicle, but you do have the piece of mind knowing that you’re not making reckless financial decisions that could impact your entire life.

(Article continues below)